GDC 2025 Reflections: Finding Optimism in Gaming's Current Landscape

A rollercoaster of doubt, resilience, and renewed belief in what’s next

Another GDC has come and gone, and I've been processing everything I saw and heard throughout the week. I believe this was my 12th GDC…and this one felt different. A mix of caution and careful hope against the backdrop of ongoing industry challenges.

As I reflect on everything I experienced, I find myself oscillating between concern and optimism about where our industry is headed. And after dozens of conversations with some of the smartest and most well-connected folks in the industry, I've come away with some perspectives I think are worth sharing.

The Industry Mood

I walked into GDC with that ominous "this is the new normal" mindset many of us have adopted. Record layoffs, cautious investment, studios shutting down—it's been rough out there. And unlike in previous years, there's no obvious new wave to ride. Several service studios I spoke with mentioned how their businesses have capitalized by catching the next trend: from Flash, to Facebook Instant, to the mobile boom, to free-to-play, to VR, and most recently, Web3.

Today, it doesn’t feel like there’s anything driving meaningful demand for new games (and, by extension, employment for gamedevs). The sectors that are growing—i.e. UGC / Roblox—feel like a totally different industry…which somewhat ironically is what most stalwarts must have thought about us at Twitch when we first arrived on the scene.

And AI is obviously the new thing, but it's not a demand driver—at least not yet. It could potentially become one, but I’m not sure exactly what that looks like.

Are There Any Bright Spots?

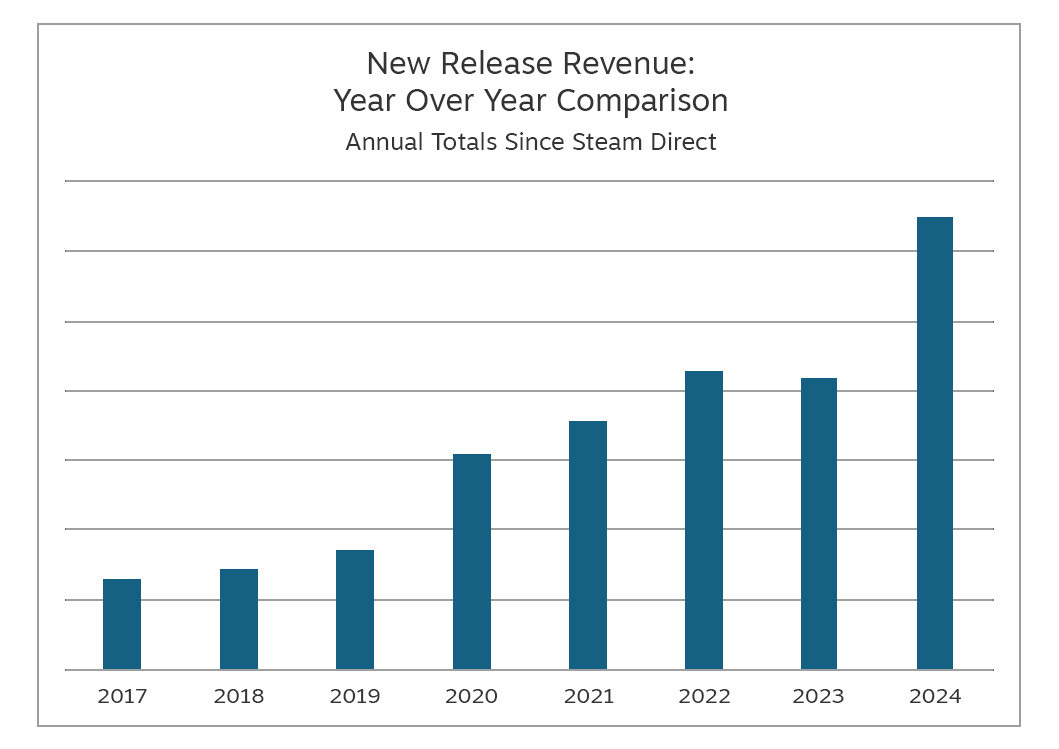

Valve has tried to paint a rosy picture leading into GDC by releasing its Steam Year in Review 2024, noting how there have been over 500 new titles that exceeded $250,000 in revenue 30 days following release, the largest year over year increase ever.

Of course, Valve is obviously biased. They're directly incentivized to highlight growth in Steam’s developer ecosystem, so it’s no surprise they’d spotlight data that paints a positive picture. And like any massive dataset, you can more or less create whatever narrative you want. Indeed the metric that they decided to present here—New Release Revenue—feels suspiciously specific.

Value’s data also contrasts heavily from the overarching narrative I hear from Steam developers themselves. Ryan K. Rigney outlined an excellent example from the developers of Arco in his September newsletter “Are Old Games Killing New Games”. Ryan concluded that the reason Arco—a game that by all traditional measures should have succeeded—ended up underperforming is due to “a mere 4.5% of Steam gaming time [in 2023] going to new titles”.

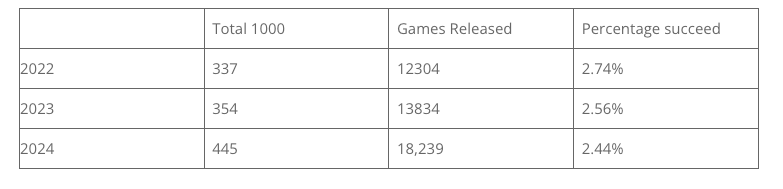

And of course, there’s the obvious explosion in new games released on Steam. Chris Zukowski noted how despite the increase in 1,000+ games, the overall percentage of success for developers went down because of a stunning ~30% increase in total Steam games from ‘23 to ’24.

H5 is the one other true bright spot I’ve noticed. Portals like Poki (65 MAU) and CrazyGames (35 MAU) are growing like crazy (pun?), and apparently have finally cracked microtransactions on the web. Telegram has produced demonstrable examples of runaway successes (Hamster Kombat’s 100M users in 73 days), and with major players like Discord fully launching activities in September and Facebook launching in-app purchases for Instant Games in November, the future of H5 looks bright.

But of course, H5 is still small. Web games command less than 1% of total global games market revenue, so more of a ripple than a wave when considered in an industry context.

Investment…?

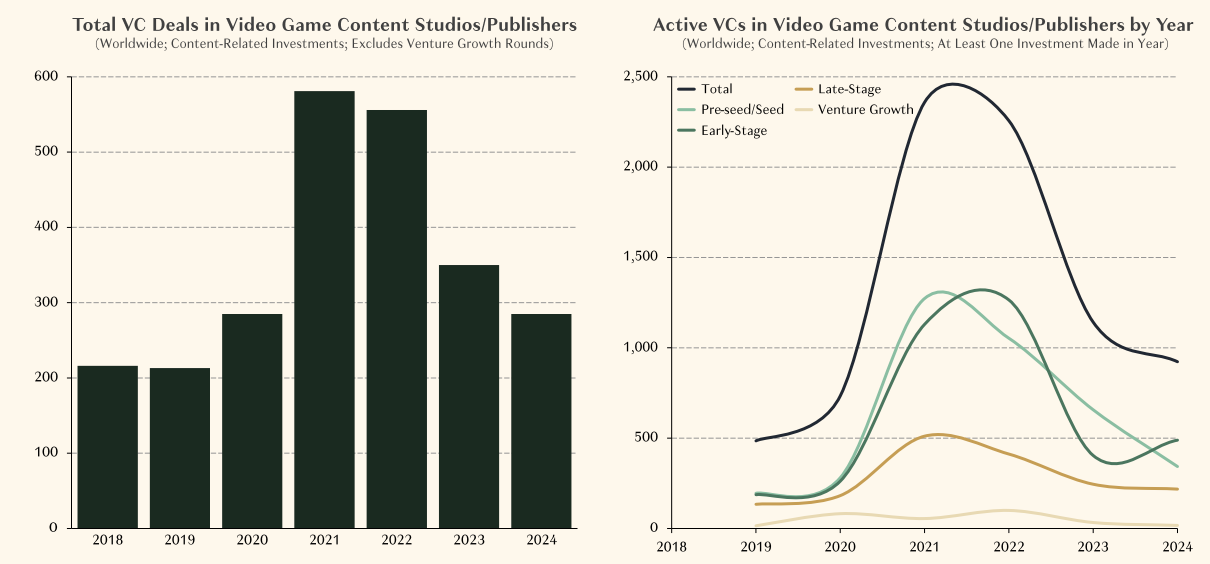

With all this uncertainty, I don’t blame investor pullback. Matthew Ball’s State of Gaming 2025 illustrates this trend beautifully in the VC market through its pricey Pitchbook data subscription (what a report, thank you Matthew!)

I really wish someone would make a Pitchbook of games publisher investments…no idea how, but count me as a customer if you figure it out. Until then, unfortunately there’s no good way to track non-VC games investment velocity. Still, based on what I’m hearing, it’s probably safe to assume the trend is similar.

I’m also hearing that platform deals—subscription services, storefront exclusivity, co-funding—have slowed down significantly. FAANG is either pulling out or stuck in yet another reorg. China is scaling back. And while consumer demand is flat at best, competition on PC and console is rising as revenue opportunities shrink. The road to success feels murkier than ever.

I don’t envy investors and publishers right now. This is my first true down cycle I’ve experienced in games, and man it’s tough to be optimistic. I completely understand why they’re requiring more hard metrics before writing checks. After all, considering the recent graveyard of well made but underperforming games, how else are you supposed to pick winners?

One point I heard raised at GDC is that developers are going to have to rethink how they approach fundraising, bringing more parties to the table to make projects happen. Whether that means smaller, more frequent rounds or raises involving multiple strategic partners, the desire to make new games is still out there, folks just need to get creative.

An example here is on the licensing side. I spoke with a few IP holders who told me that before the recent downturn, when they brought a well-known IP to market, they’d have 4–5 fully-funded developers vying for the license. Today? That money just isn’t there. Instead, new models that bring together developers, investors, and the IP holders themselves are being explored to get projects off the ground.

Other indie developers I spoke with have struck cashless rev-share deals with longtime collaborators with whom they have deep trust to bring new projects to life. I LOVE this scrappyness, and am deeply wishing that these builders and hustlers are rewarded in due time.

Like any change, this one creates opportunity—for those persistent and willing to put in the work to get deals done.

The Mindset Shift

Luckily, a couple conversations late in the week (thank you David Bergantino and Nicholas Fortugno) drew my attention to two critical points:

1. We've been here before

This isn't the first time the industry has experienced a downturn. And every time before, it's always come back stronger. When you're in the middle of it, everything seems doom and gloom. But that's the thing about innovation—if we knew where it was coming from, it wouldn't be innovative.

2. Gaming's audience is famously fickle

Our customer base—gamers, many of whom are young adults—are notoriously fickle consumers. There will always be a time when the next generation decides whatever the older generation is doing is no longer cool. There are always new trends, new fads, and new social spaces.

You see the same pattern in social media, where network effects are even stronger—younger generations wants its own space and don't want to be where their parents hang out. Just look at the progression: Facebook > Instagram > Snapchat > Twitch > TikTok.

Finding Balance Between Reason and Faith

(Wow, serious headline.)

As a rational systems thinker, it's hard to simply have blind faith in a turnaround. But if you look back, history is on our side. The games industry has always evolved, adapted, and found new audiences.

What makes this downturn feel different is that we're coming off an abnormal period of growth. The pandemic created an unusual surge in gaming engagement and investment. What we're experiencing now is a return to a more sustainable trajectory, complicated by broader economic factors.

The point is…we can worry, but I don’t think we need to, and those who have been around longer than me seem to agree. Yes, GDC was smaller this year than in years past, but for myself and many others I’ve spoken to, the meetings felt more important.

Building Partnerships, and Looking Ahead

I don't know exactly what's coming next. But I'm convinced that innovation will emerge, probably from unexpected places.

What I do know for sure is this: success will require adaptation. The folks at GDC who gave me the most hope were the ones out there hustling—scrappy, creative, and relentless. They’re finding ways to bring new projects to life, tackling old problems with fresh approaches, and figuring out how to create real value in a shifting landscape.

The next wave that drives growth in game development might not even look like a "game" at first. Early at Twitch, nearly every meeting started with us having to explain why people were interested in watching other people play games. Today, it’s an entirely new entertainment category with a massive impact on how games are discovered.

For now, I'm taking the long view and choosing optimism. The games industry has always been resilient, and I believe we'll look back at this period as just another cycle in our ongoing evolution.

What do you think? Are you seeing signs of the next wave of innovation? I'd love to hear your thoughts.

This is great writing and very insightful Brooke! I totally agree and it's hard to pinpoint the reason for optimism purely from easily diagrammable data, but I "feel" it through my weird ways of analyzing the overall what I'm going to call "vibe data" of the industry.

The only thing about the article is that from my sources, attendance was actually up from 25000 last year to 30000 this year.